AppraisalWorks is the real estate appraisal management technology platform you need to align stakeholders and boost profitability.

Innovation so unique, it’s patented under U.S. Patent 10,635,999.

Why AppraisalWorks is your best choice for:

Protect your data — AppraisalWorks provides unmatched security. You choose where to store your data, on the Cloud or behind your firewall.

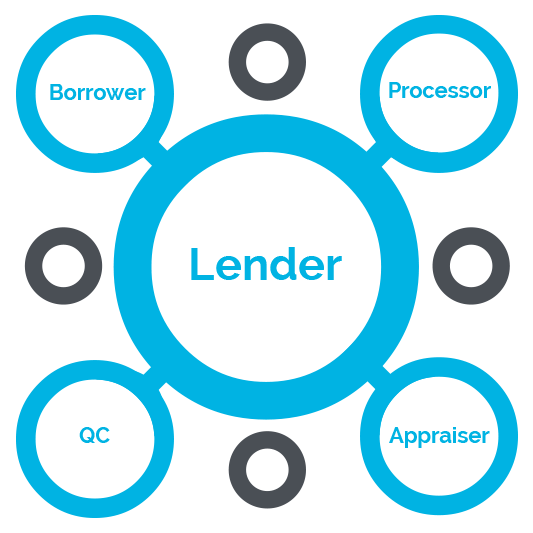

Improve visibility and control — manage all your appraisers and AMCs on one appraisal management platform.

Get the big picture — AppraisalWorks can handle all real estate appraisal and loan types.

Gain a strategic advantage with the most complete solution for managing your real estate appraisals, appraisal reviews, vendors and collateral portfolio.

See what our clients have to say.

“AppraisalWorks has been wonderful to work with! I really appreciate all the assistance they have provided to me, and my team and that they take my feedback seriously and in a lot of instances, often implement. I’m just really thankful I get to work with the AppraisalWorks team!”

– Ashley Gebben with Aloha Capital

“We always receive great service from the team at AppraisalWorks – quick replies to our inquiries and we appreciate how easy and intuitive the AppraisalWorks platform is to utilize!”